Bend’s commercial real estate market is frequently described as insulated from many of the pressures affecting national markets: Demand is driven by steady in-migration tied to lifestyle. Limited land, slower entitlement processes, and infrastructure constraints effectively cap new supply. Construction costs remain high, in part because the local labor force must afford to live here, and because system development charges tied to infrastructure improvements often make it more cost effective to buy or lease existing space than to build new. Bend’s diverse economy, anchored by healthcare, tourism, data centers, and small businesses, further reduces exposure to single industry shocks and helps keep real estate fundamentals more stable through economic cycles.

That insulation does not mean Bend is immune. Pricing adjusts, rent growth pauses, and transaction velocity slows, but the downside tends to be muted relative to national markets.

One factor impacting real estate at both the national and local level is the lending environment. Post-pandemic interest rates allowed investors to generate returns even without significant rent growth. Today, income plays a much larger role in asset performance, placing greater emphasis on attracting and retaining the right tenants and improving operations to drive net income. In this environment, active asset management has become instrumental in controlling expenses, maximizing income, and improving overall returns.

Capital is beginning to free up in 2026. Regulations have made it easier for large banks to purchase U.S. government bonds, which could help lower long-term interest rates and give banks greater flexibility to lend, particularly on lower-risk commercial real estate such as core and stabilized assets. Banks may reenter deals they previously passed on, though underwriting standards remain conservative.

Against national metrics, the Bend MSA demonstrates its insular factors across most sectors:

Office

National Vacancy: 14.0%

Bend Vacancy: 6.7%

Nationally, improving demand and rent stabilization have allowed for positive absorption for the first time in several years, restoring some investor confidence. The office sector posted the largest increase in sales volume in 2025, nearly doubling industrial sales and outperforming multifamily and retail by roughly $4 billion each.

The construction pipeline remains limited, which is expected to constrain future availability. The flight to quality is evident across the board, with tenants choosing fewer, higher-quality buildings over larger footprints in lower-quality space. In Bend, 4- and 5-Star rents continue to grow, while 3-Star assets are flat to slightly negative.

While the Bend office pipeline appears elevated at 174,000 square feet under construction compared to the ten-year average of 100,000 square feet per year, much of this activity is concentrated in owner-user or institutional projects. These include the Deschutes County Library (10,202 SF), the Pacific Corp building in Juniper Ridge (45,000 SF), and the St. Charles Cancer Center in Redmond (102,000 SF). The remaining availability is limited to two buildings, both of which reportedly have leases pending or tenants in tow.

Retail

National Vacancy: 4.3%

Bend Vacancy: 3.8%

Continued strength in consumer spending continues to support retail demand. Fewer move-outs, steady backfill leasing, and minimal new supply have reinforced retail fundamentals.

Many national retailers remain in expansion mode heading into 2026. In Oregon, brands like Chick-fil-A continue to grow their footprint, indicating ongoing confidence in consumer-driven real estate.

While the Bend market is often associated with boutique retailers and local restaurateurs, this has not negatively impacted retail performance. Retail remains one of the tightest sectors locally, supported by modest rent growth and constrained supply. New construction is limited, with activity primarily focused on the north end of Redmond adjacent to Goodwill and a small number of proposed projects along Century Drive.

Industrial

National Vacancy: 7.5%

Bend Vacancy: 3.3%

After serving as the standout performer during the pandemic, the industrial sector is now experiencing a supply overhang, though construction activity moderated in 2025. At current absorption levels, properties exceeding 100,000 square feet may take up to three years to lease. Sublease availability is also at historic highs, and ongoing trade conflicts continue to weigh on West Coast port markets exposed to Chinese trade.

Industrial development is being shaped by specialized uses including data centers and life sciences. Nvidia and Eli Lilly’s $1 billion AI drug lab investment outside San Francisco reflects the market’s shift to advanced computing, biotech, and R&D infrastructure.

In the Bend MSA, the industrial pipeline also appears elevated, with approximately 410,000 square feet under construction compared to the ten-year average of 260,000 square feet per year. However, more than 70 percent of this space is already spoken for. Projects include self-storage on American Loop (102,000 SF), the City of Bend Public Works facility in Juniper Ridge (102,000 SF), and the Amazon distribution center in Redmond (83,559 SF).

Multifamily

National Vacancy: 8.3%

Bend Vacancy: 10.9%

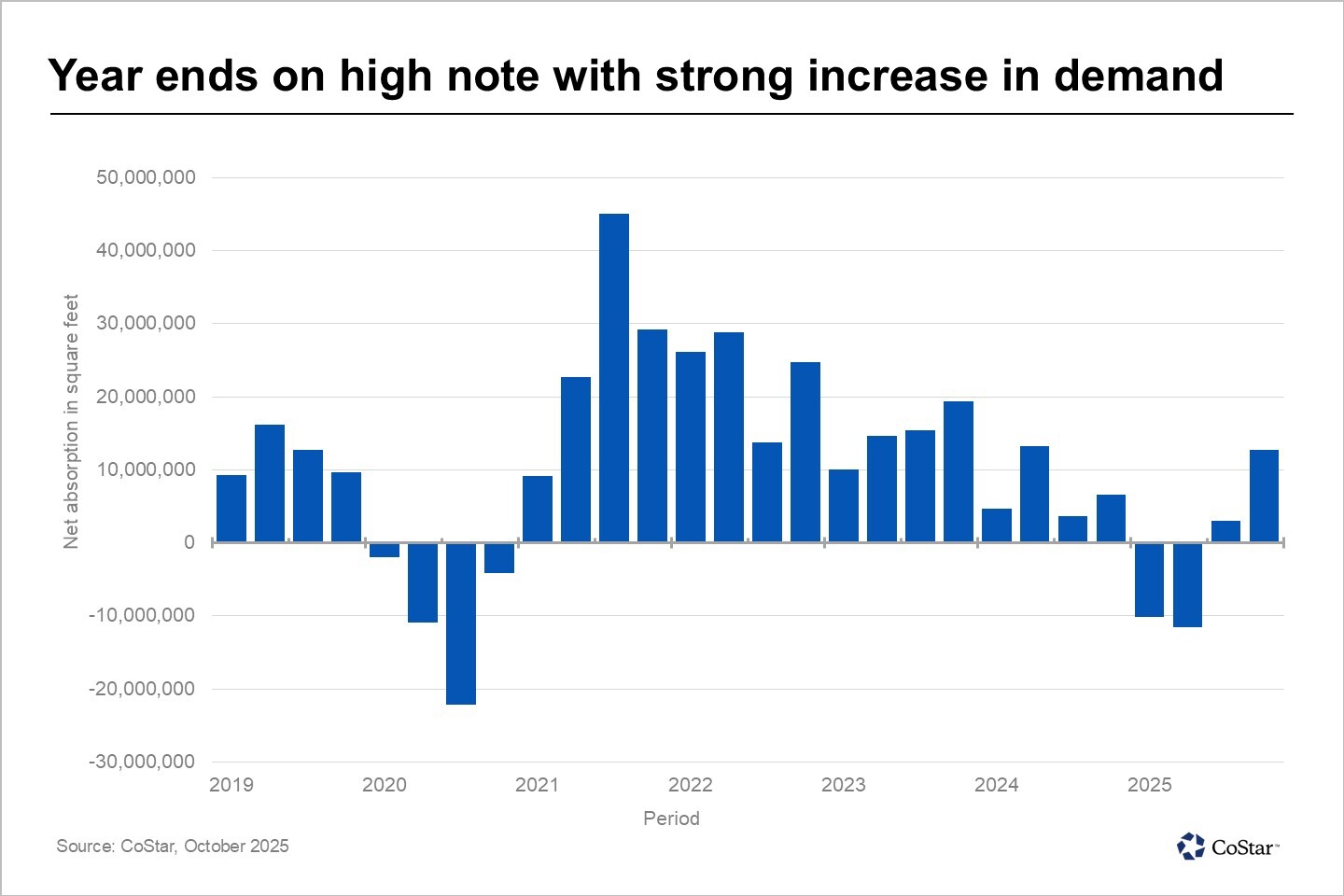

Multifamily is the other sector facing a notable supply overhang both nationally and locally, driven primarily by new luxury product. Following a 40-year high in completions in 2024, new construction declined by approximately 20 percent in 2025. By the end of 2025, absorption was expected to outpace new deliveries for the first time since 2021, setting the stage for tightening conditions in 2026.

In Bend, one- and two-star properties posted modest rent growth while 3-Star assets remained flat. With construction activity effectively paused, recent leasing reflects a return to normalized conditions. Vacancy is expected to trend back toward Bend’s stabilized level below 5 percent by early 2027.

Emerging Markets

While self-storage, senior housing, and student housing have long been viewed as attractive investment options, they are increasingly being classified as their own commercial real estate verticals beyond the traditional four property types. Demand for these assets is driven by life events and demographics rather than economic cycles, allowing them to remain resilient during downturns.

Their performance depends heavily on operations rather than location or lease structure. Rates reset frequently and management decisions directly impact returns, making these assets operate more like businesses than passive real estate investments.

These property types have emerged as distinct verticals because their demand, risk, and returns are shaped by demographics and operations, offering investors an additional avenue for diversification.

Overall, Bend’s commercial real estate market reflects many of the same dynamics playing out nationally, but generally with less volatility. Supply conditions vary by property type, with industrial and multifamily sectors working through near-term overhangs while office and retail remain constrained. Demand continues to be supported by established local drivers, and capital conditions are beginning to improve. Performance is differentiated by asset quality and management, with income, operations, and management of the two playing a pivotal role in returns.

While the market continues to adjust alongside the broader economy, Bend’s performance indicators point to a stable path and continued market improvement over the next 12-18 months.